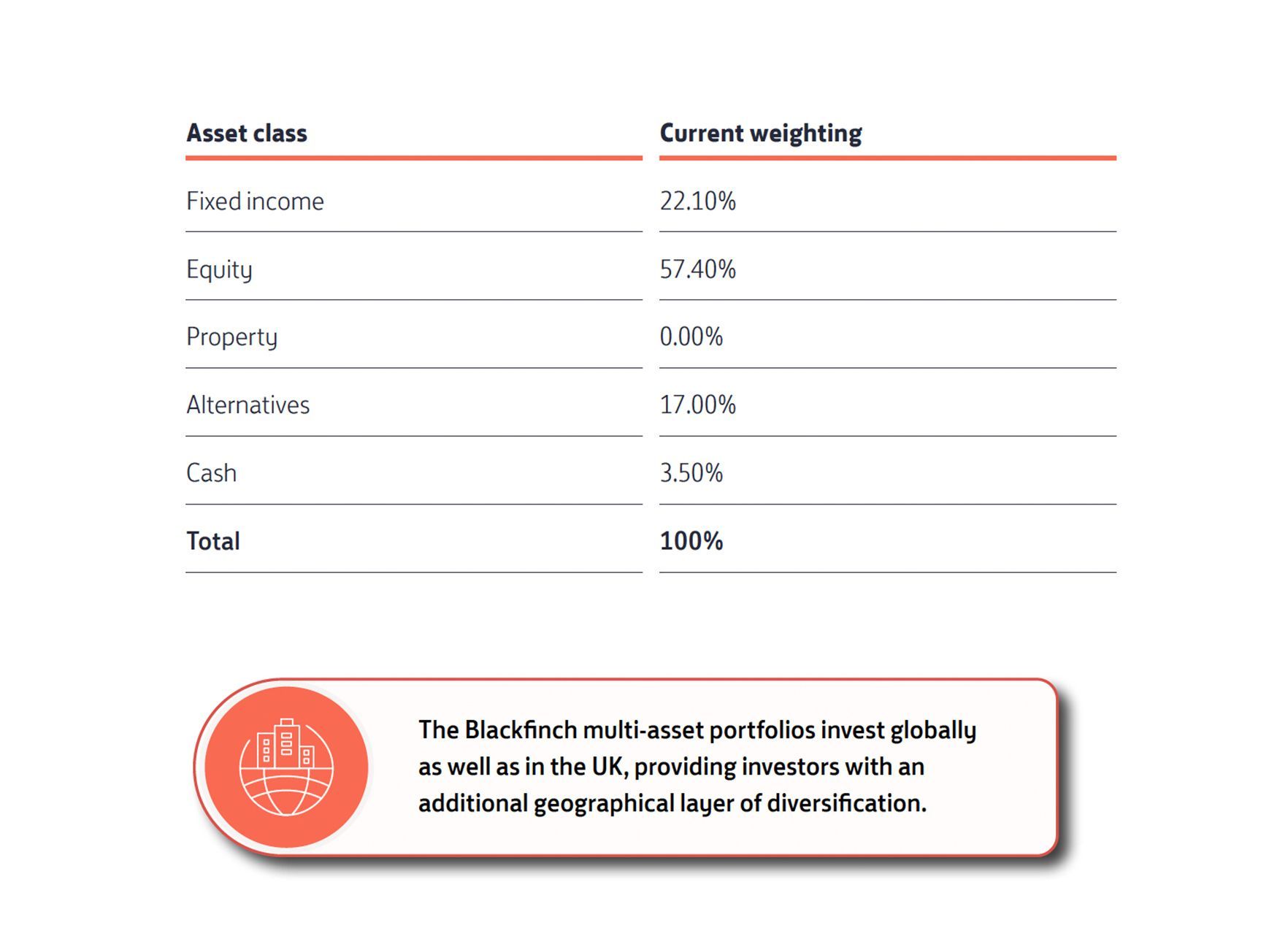

Blackfinch’s multi-asset portfolio range offers six different investment strategies: Defensive, Cautious, Balanced, Growth, Enhanced Growth and Income. Each contains a uniquely weighted exposure to fixed income, equity, property, alternatives and cash in order to offer investors different profiles of risk and return.

Using our Balanced portfolio as an example, the table below shows the breakdown of the underlying asset class weightings:

The Blackfinch multi-asset portfolios invest globally as well as in the UK, providing investors with an additional geographical layer of diversification.

The FTSE100 index reflects performance of shares listed on the UK stock market only.

As our multi-asset portfolios contain a diversified range of asset classes and geographies which differ from the FTSE index, naturally their performance won’t mirror that of the FTSE index.

If the UK FTSE100 is holding up so far this year, what is impacting other investments?

Economic confidence remains mixed given the Ukraine and Russia conflict. While the initial shock and uncertainty has been priced into global equities, the longer-term effects remain difficult to quantify and financial markets have historically not been receptive to a broad range of data points with an even wider range of investment outcomes.

So far this year, the UK has shown strong resilience due to its exposure to materials and energy, which can pass the cost of inflationary pressure to customers. The picture has been similar since the start of the year, with shares of larger companies rising. This was driven this month by the mining, healthcare, and oil sectors, while small and mid-cap equities recorded losses. One change from January was a greater presence of more traditionally defensive sectors among the market’s outperforming areas. These included consumer goods, drinks, and utility companies, to take three examples.

How economic conditions could impact portfolios containing growth stocks

Growth stocks are the shares of companies which typically grow at a higher rate than the market average.

The macro headwinds mentioned above are currently feeding into the globally allocated equity holdings of our portfolios and, so far, 2022 has seen a notable “correction” in growth stocks. This is particularly prevalent in the US, China, and the emerging market regions.

The share prices of growth stocks are highly sensitive to their projected future earnings, which, right now, are coming under pressure due to rising inflation expectations and uncertainty over how long inflation will remain elevated for.

An addition, some growth companies can be more “cyclical” in nature i.e., they follow the investment cycle of expansion, peak, contraction, and trough. This means that these types of company tend to outperform during the expansionary stage and peak stages and underperform during the contraction and trough phases of the investment cycle.

What if my portfolio contains value stocks?

Value stocks, on the other hand, are companies which trade below their intrinsic value. Many UK listed stocks would be considered value stocks.

These business types have tended to be more resilient to the current inflationary challenges, hence the relative outperformance you may have noticed in UK stocks this year.

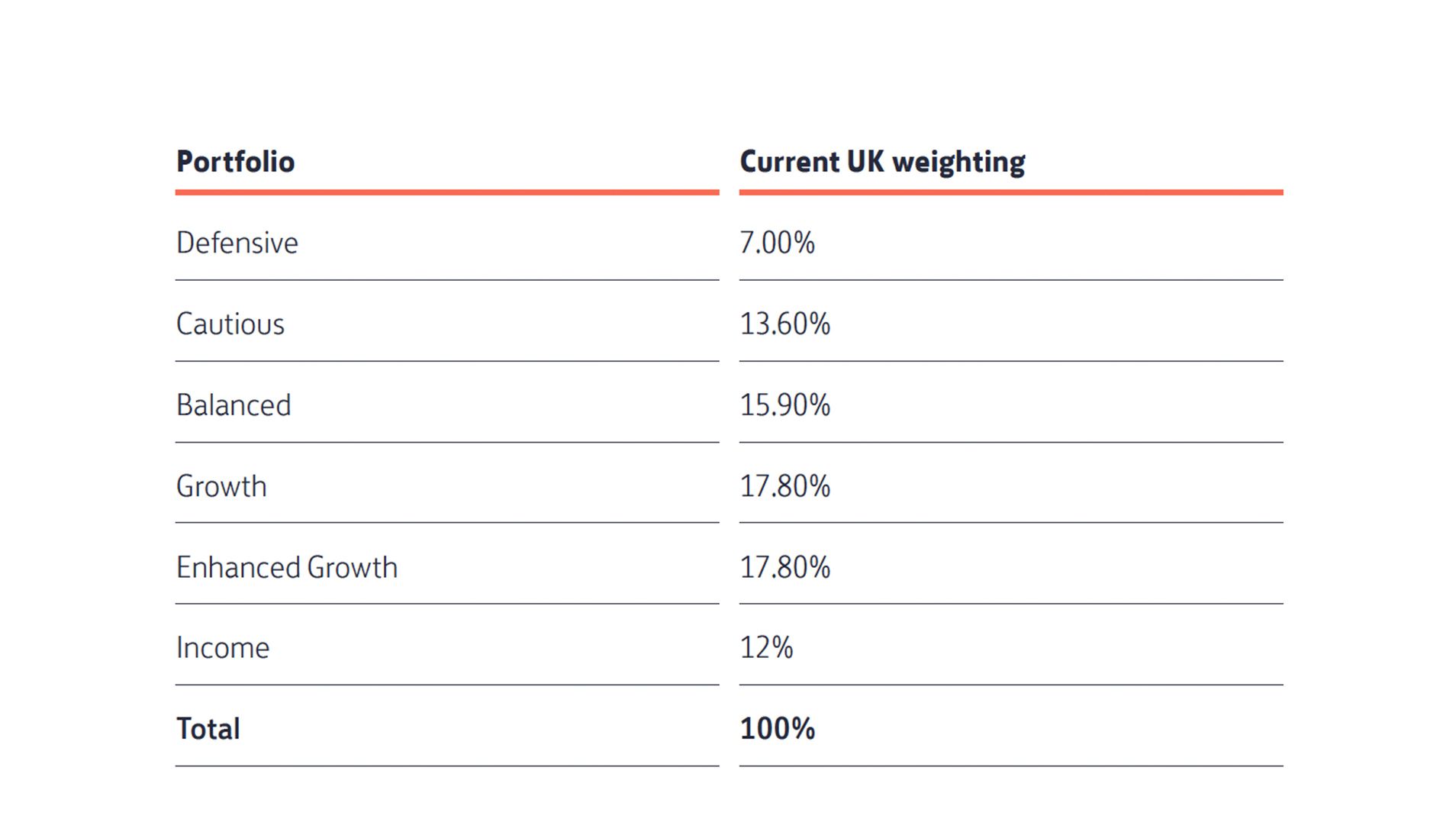

The Blackfinch multi-asset portfolios contain relatively low weightings of UK equity in comparison to other assets and geographies as part of our strategic approach to diversification. By offering a low concentration risk we are able to help investors mitigate the volatility or uncertainty individual markets may experience.

Our UK equity exposure across our multi-asset portfolios is outlined below. Please note, as active managers these allocations are subject to change.

Diversification is key to outlasting market conditions

As market movements occur, the performance of different asset classes will vary. Layered over this are the differences felt at a geographic level too. For investors to outlast changes happening both on a macro and micro level, they will need to build a portfolio of diverse and varied investments.

This will enable investors to experience different performance at different times across their investments.

As a discretionary fund manager without in-house financial advisors, we understand that our financial advisor partners will use our products and services within a wider mix of products to meet their investor objectives.

If your investors are considering diversifying their portfolio across both geographies and asset classes, then speak to one of our team today about Blackfinch Asset Management – part of a wide range of ESG-aligned (environmental, social, and governance) investments available from Blackfinch Investments.

Your capital is at risk. The value of your investments could go up as well as down and you may not receive back the full amount you invest.