When market performance starts to fall, inevitably investors begin to question their investments and whether their portfolios are best placed to weather the change. This may cause investors to withdraw funds for fear of devaluation. But the challenge these investors would face is in understanding when to re-enter the market.

Consider the returns of the global stock market (MSCI All Countries World Index) since the start of 2000 up until May 2022. This period includes some of the worst stock market crashes on record including the Dot Com crash, the 9/11 Twin Towers attack, the Iraq Invasion, the Global Financial Crisis, COVID 19 and the ongoing situation with the Russian invasion, inflation fears and interest rate hikes. Despite these major events, if an investor had held their investment for the entire period, they would have returned just over 82%.

More importantly though is to see what would have happened if they’d sold out of the market and tried to time their re-entry. It is impossible to predict exactly when the ‘bottom’ of the market is, and history shows us that some of the best, and most pronounced, upside returns have happened in the most challenging economic times.

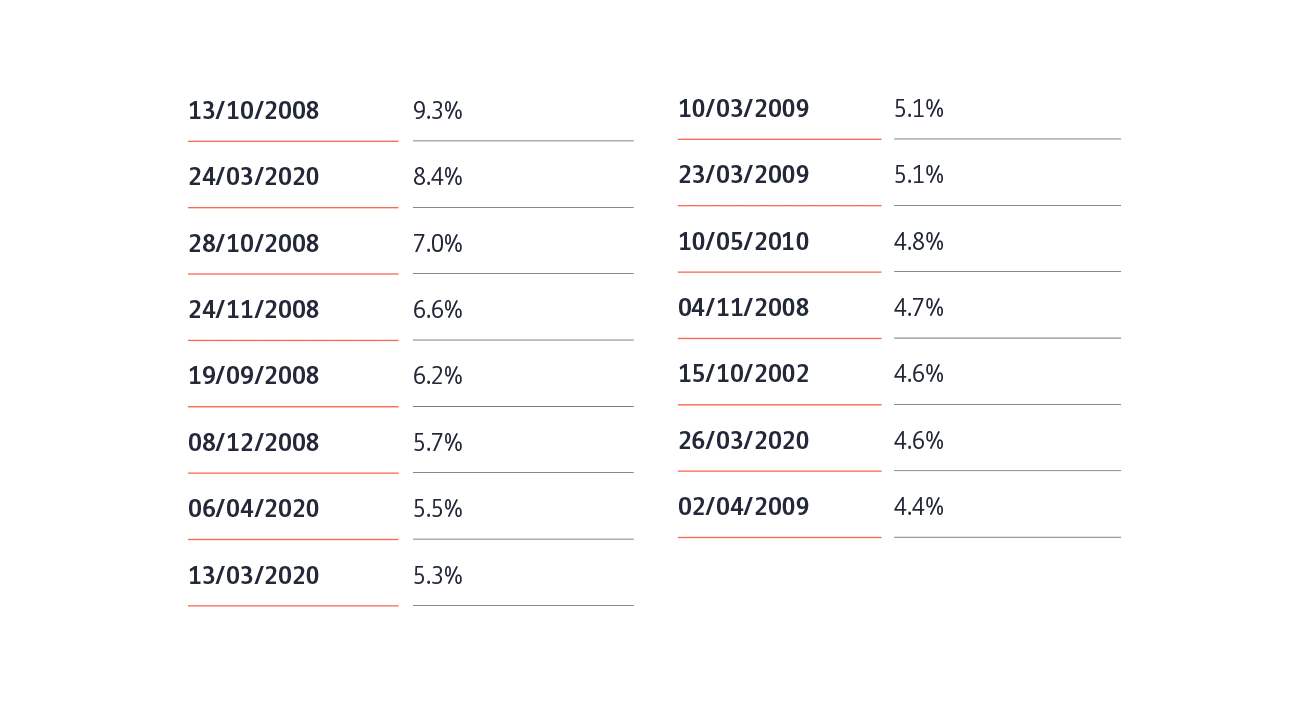

The following table sorts the top 15, single day returns for the global stock market since the start of 2000. Notice how these best returns all happened at a time when investors would have been at their most nervous.

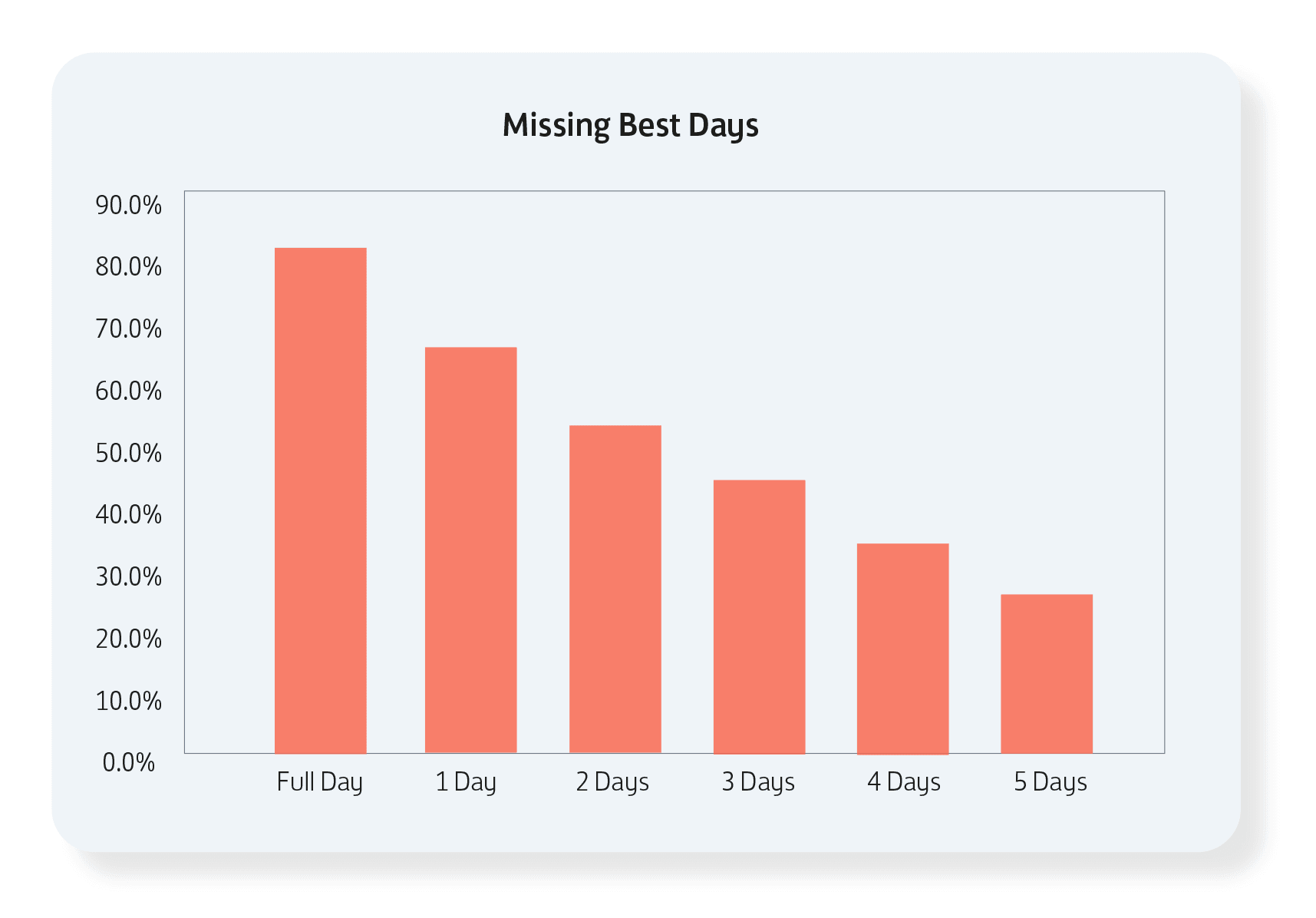

Another way to look at it is by assessing what would have happened if clients had sold out of the market and missed some of these upside days. The following plots what would have happened to an investor’s returns if they’d missed 1,2,3,4 or 5 of these top performing days (the first bar shows the return if they’d stayed invested over the entire period for reference):

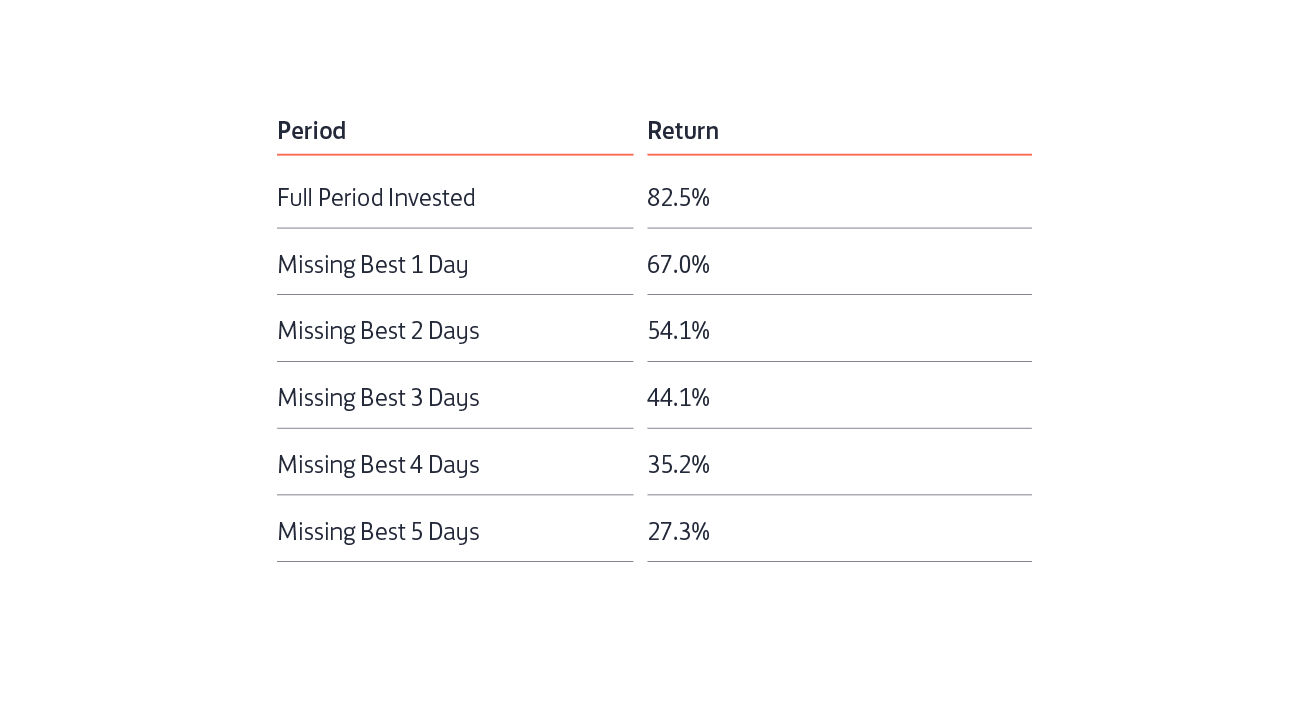

For reference the table below shows the exact return figures plotted on the above chart.

As you can see, by missing just 1 or 2 of those best days during the past 22 years would have significantly reduced the client’s overall returns.

Looking at the data also highlights how quickly and dramatically upside moves can come to markets and it is our job as investment managers to ensure your client portfolios are positioned to make the most of those upturns when they arrive and to ensure the overall risk in managed in line with their expectations.

How long will it take to outlast the market?

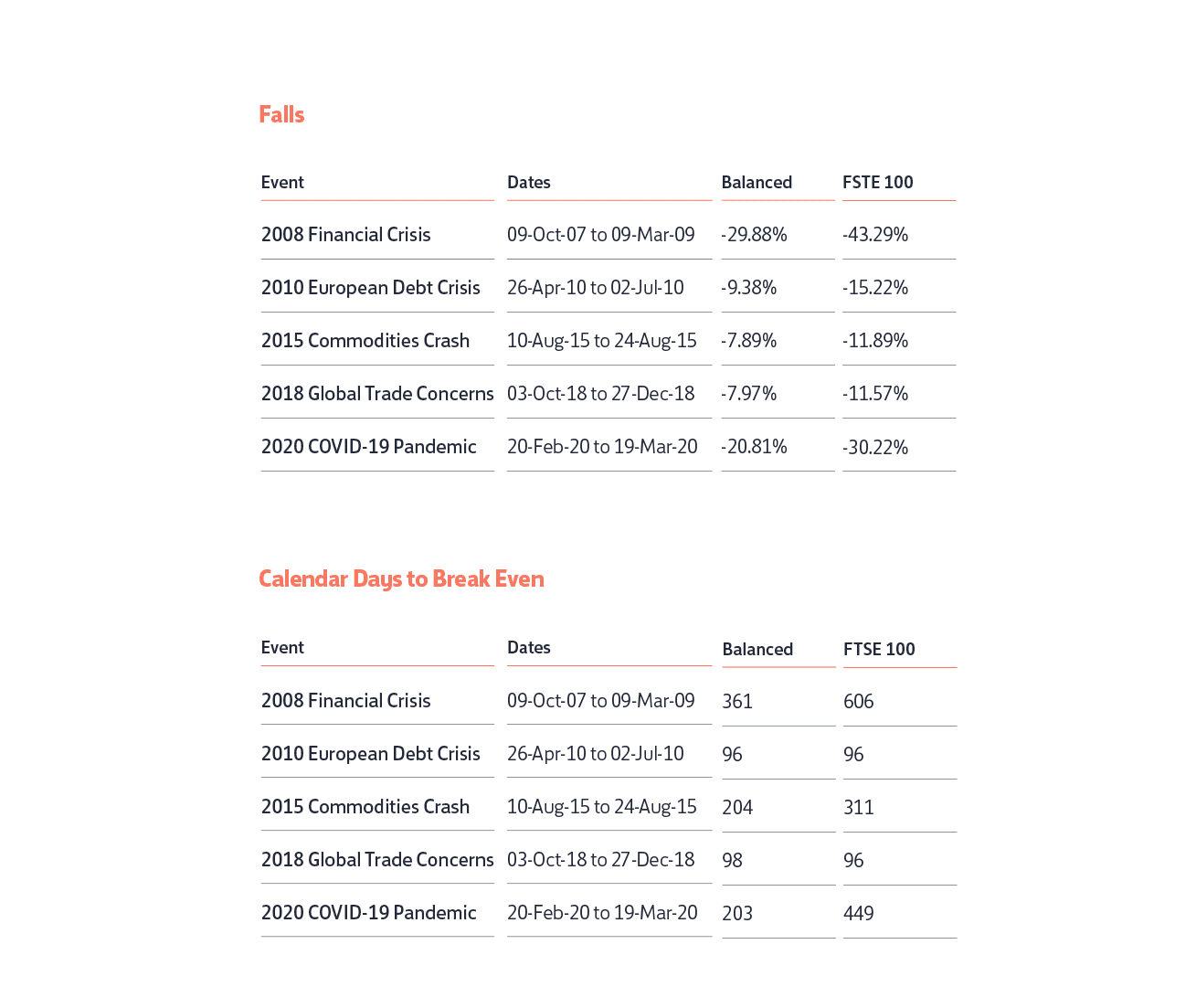

Times of market stress are, unfortunately, part of the investment journey of any portfolio. Using our Balanced portfolio as an example, here we look at the historic market downturns, with the first table showing the loss that the portfolio would have suffered during these periods. As market cycles turn, these losses will typically be followed by a recovery. The second table details how many days it would have taken for every penny of that loss to be recouped should the investment portfolio be held throughout the cycle. We have added the FTSE100 as a reference point.

Source: Bloomberg. Calculations are made on a total return basis. Simulations, either historic or forward looking, should not be considered a guarantee of future performance.

All annualised data provided above is calculated up to the 31st December 2020. All data uses simulations based on strategic asset allocations up until our portfolio launch (this being the 2/7/18 for all portfolios except Income, which was the 14/05/2020). The simulations do not take into consideration any commissions, fees or other charges which would reduce the actual return received.

If your investors are considering diversifying their portfolio across both geographies and asset classes, then speak to one of our team today about Blackfinch Asset Management – part of a wide range of ESG-aligned investments available from Blackfinch Investments.

Your capital is at risk. The value of your investments could go up as well as down and you may not receive back the full amount you invest.