Time for a New Perspective on Diversification?

Diversification should be at the core of every portfolio, at least according to traditional financial theory. But the recent period of economic uncertainty means both financial advisers and their clients continue to question whether investment portfolios constructed by traditional approaches are capable of achieving the expected client outcomes.

This article will focus on exploring the impact of adding different asset classes including alternatives to the overall asset allocation mix and what this means for the relationship between risk and return. Obviously it is possible, and could also be beneficial, to add alternative investment strategies to a client's portfolio using open ended structures - but this paper will take the strategy one step further by exploring whether it would be possible, or in the client's best interest, to utilise tax advantaged products to create the overall asset allocation for clients.

For this strategy to work an adviser is central to ensure a holistic view is taken on the client's overall situation, to assess whether the additional product risks would be appropriate.

This is based on a research paper written by Blackfinch Chief Investment Officer Listed Investments, Dan Appleby, titled: 'How portfolio diversification can potentially boost returns and help justify the value of advice.'

How Traditional Asset Classes Perform Through Economic Cycles

On a very basic level, investors should avoid putting all their eggs in one basket. However, diversification is not about how many assets are in a portfolio, but how different the assets are that make up the portfolio. Achieving a well-constructed portfolio with the right mix of differing assets should be the starting point for every investor.

The real purpose of diversification is to provide support in times of market weakness; to limit drawdowns and reduce volatility. But over the last 20 years, the annual returns of both equities and bonds have been too closely correlated for comfort.

Chart 1 shows the performance of two commonly-used exchange-traded funds (ETFs). One tracks the S&P 500 index (used as a proxy for an investor’s equity exposure), while the other fund tracks the US investment grade corporate bond market (representing the most creditworthy of companies with much lower chance of default during recessionary periods).

Returns are calculated on an annual basis up to 2022.

Taking an example, in 2022, amid a cost-of-living crisis, war in Ukraine, and an economic slowdown, both proxy funds experienced double-digit drawdowns. Therefore, a traditional 60:40 equity/bond portfolio does not offer much in the way of diversification in certain market conditions. So, we need to look a bit deeper in terms of what a well-constructed asset allocation should be.

Optimising Asset Allocation

Using Alternative Asset Allocations

Modern portfolio theory reminds us that we cannot increase expected returns indefinitely without increasing the risk of the portfolio. But to continue to meet client outcomes, investment portfolios need to have a broader asset allocation featuring a healthier combination of uncorrelated assets.

So, is there a hypothetical ‘sweet spot’ where we can optimise asset allocation without ramping up risk?

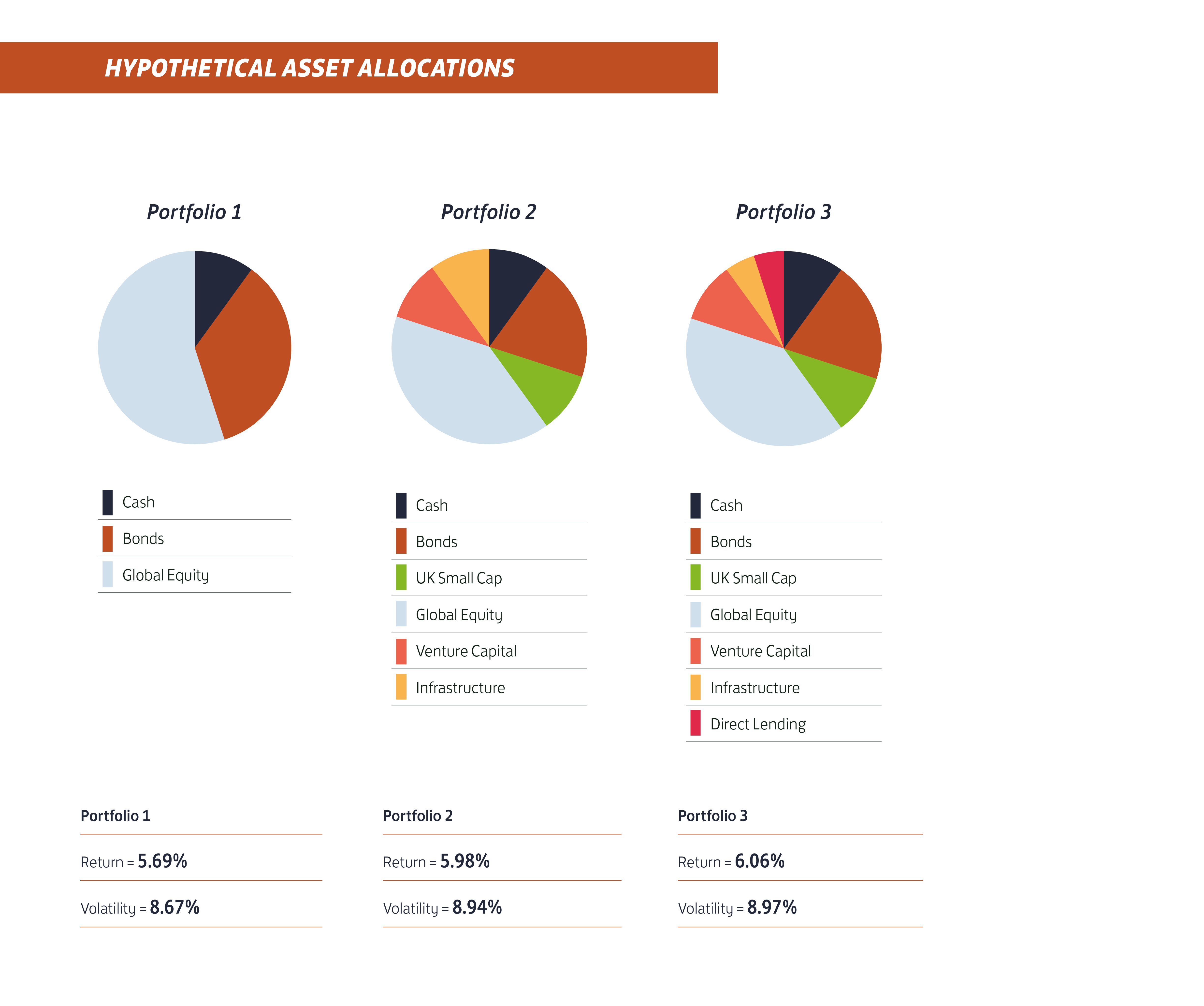

The following three hypothetical portfolios represent three distinct asset allocations. Portfolio 1 represents the traditional equity/bond/cash portfolio, while Portfolios 2 and 3 introduce additional asset classes, such as UK small cap stocks, venture capital, infrastructure, and direct lending, using different weightings for both.

Portfolio 1 asset allocation is set at 10% to cash, 35% to bonds and 55% to equity, which we would suggest is a reasonable approximation to a standard ‘Balanced’ portfolio. This portfolio is usually scored at risk level 5 on a scale from 1-to-10, and the annualised return is expected to be 5.69%, with an annualised volatility of 8.67%. However, this portfolio is quite some distance from the efficient frontier, and as such, there is considerable scope to optimise asset allocation.

Portfolio 2 is weighted 10% to cash, 20% to bonds, 40% to global equities, 10% to UK small caps, 10% to venture capital, and 10% to infrastructure. These additional assets are chosen to diversify the portfolio, as for example, the correlation between global equity and infrastructure is 0.12, and the correlation of venture capital to bonds is 0.07. We can see that the return of this portfolio rises to 5.98%, but with only a slight increase in the expected volatility to 8.94%. As such, the portfolio has moved closer to the efficient frontier.

Portfolio 3 is weighted in a similar way to the second portfolio, but now with a 5% infrastructure allocation and a 5% allocation to direct lending. The expected return increases to 6.06%, but with only a fractional increase in expected volatility to 8.97%. Adding an additional asset into our allocation mix results in the portfolio moving closer towards the efficient frontier, as we continue to optimise asset allocation and increase risk-adjusted returns. The result? Moving from left to right, the portfolio and associated asset allocation has resulted in enhanced risk-adjusted returns.

How Can Advisers Optimise Portfolios to Achieve Better Investor Returns?

How Can Advisers Optimise Portfolios to Achieve Better Investor Returns?

Now we have expanded our asset allocation and optimised our portfolio, we can calculate what an investor with a starting pot of £500,000 would achieve over a long-term investment horizon.

Assuming an investment horizon of 15 years to cover a typical retirement period, and compounding the initial £500,000 investment pot at different returns, produces the below results:Initially, what is most apparent is the power of staying invested: an initial investment pot of £500,000 invested over the 15-year period can turn into a £1 million+ portfolio if returns are allowed to compound over the long term. However, notably the investor that achieves an annual return of 6.1% after portfolio optimisation achieves almost £67,000 more than a portfolio that is constructed to return 5.7% annually.

Today, advisers have a much harder job of finding and selecting the right asset classes to diversify their clients’ portfolios and achieve the desired outcomes.

Fortunately, there are many good options to choose from within the asset classes discussed above. For example, a Managed Portfolio Service (MPS) offers investors a ready-made generally diversified portfolio combining passive and active exposure to equity and bond markets, while also introducing certain alternatives strategies to bring another element of diversification.

Let’s now explore the alternative asset classes, outside of managed portfolios, that a client might consider as part of their overall holdings.

Beyond Conventional Assets

Venture Capital

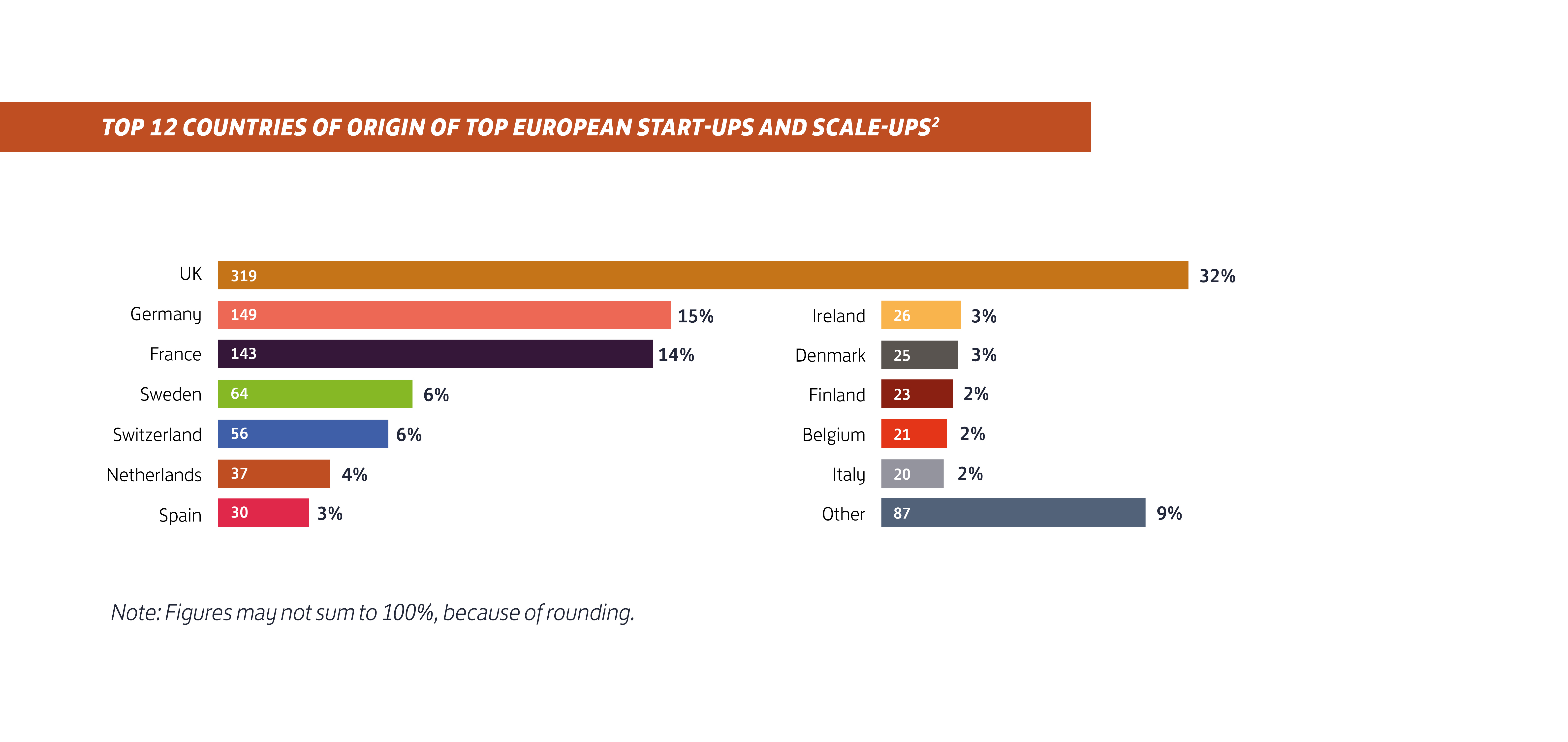

UK investors seeking growth cannot afford to ignore the venture capital market. The UK is home to the greatest number of unicorns – billion pound privately-held companies – in Europe. The chart below demonstrates just how successful the UK is when it comes to starting and scaling successful entrepreneurial businesses.

But while financial advisers can and should consider exploring ways to capture this growth potential, it’s not possible to use passive investments to track or replicate the performance of privately-owned companies. Therefore, the best way to add exciting early-stage unlisted companies to a client’s portfolio is not through an MPS, but through tax-efficient vehicles such as Venture Capital Trusts (VCTs) or the Enterprise Investment Scheme (EIS).

The Blackfinch Ventures VCT or EIS investments provide investors with access to a ready-made portfolio of early-stage businesses, adding a further level of diversification to help manage the risk associated with this asset class.

Investments made into in these tax-efficient vehicles must be held in the investor’s own name, in order to claim and retain any associated tax benefits, rather than holding through a fund within an MPS.

Beyond Conventional Assets

The Alternative Investment Market

The Alternative Investment Market (AIM) is the London Stock Exchange’s junior market for companies seeking equity capital to accelerate growth, in a similar way a company would look to raise capital from the venture capital market.

While it is likely an MPS would invest in UK small caps, AIM is generally not a market an MPS would have significant exposure to, if any. First, there are no passive funds that track AIM, and nor would an investor want to. That’s because of the higher risk profile of AIM-listed stocks relative to larger companies listed on the main exchange.

Nevertheless, AIM is where entrepreneurial young companies can carry on their growth trajectory. AIM offers companies an excellent route to initial public offering (IPO), and as such, there are hundreds of growing companies to choose from. A good active investment manager should be able to pick the best prospects on AIM so that investors can add exposure to this unique market in their portfolios.

Importantly, some companies listed on AIM qualify for Business Relief, which means investors owning shares in these companies can use them to reduce the Inheritance Tax (IHT) due on their estate.

As with the tax benefits available through the EIS and VCTs, the shares must be held in the investor’s own name through a discretionary portfolio service, which would prevent clients from claiming IHT relief if these same shares are held through funds within an MPS.

Therefore, adding a discretionary portfolio like Blackfinch Adapt AIM (ISA) to an investment portfolio can give clients exposure to growing UK companies, while also adding the potential for IHT relief.

Beyond Conventional Assets

Direct Lending and Infrastructure

A more diversified asset allocation would also consider direct lending and infrastructure assets. This could be done by investing via open ended structures very effectively, but this paper focusses on tax advantaged solutions.

Direct lending may appear to be inaccessible as an asset class for most investors, although there are investment managers that do offer exposure to this area.

For example, the IHT planning portfolios managed by Blackfinch invest in companies in the private markets (outside of AIM) that operate within asset-backed and property development lending. Property sectors typically cover residential, commercial, leisure, retail, supported living, healthcare and student accommodation, while asset-backed lending diversifies further through bridging loans to support a range of businesses. The diversified nature of these portfolios also means investors have greater control of their capital and can withdraw funds should their personal financial situation change.

Aside from added diversification if choosing to invest in these areas, investors would also gain the full benefit of potential IHT relief on the investments in as little as two years. In the same way as AIM and venture capital, this is only possible through a discretionary portfolio service, and not if these types of investments are held in an MPS.

The advisers of tomorrow should be the ones who offer new and alternative ways to achieve client outcomes. By using alternative investments to match an overall asset allocation it is possible to offer additional returns as well as realising additional tax benefits that were previously undiscovered.

A Worked Example Using Tax-Advantaged Investments Within a Portfolio

Recent UK Government legislative changes, as well as increasing house price valuations, are putting tax thresholds within reach of a much greater proportion of the population. This means incorporating investments with added tax reliefs has become even more relevant today than ever before.

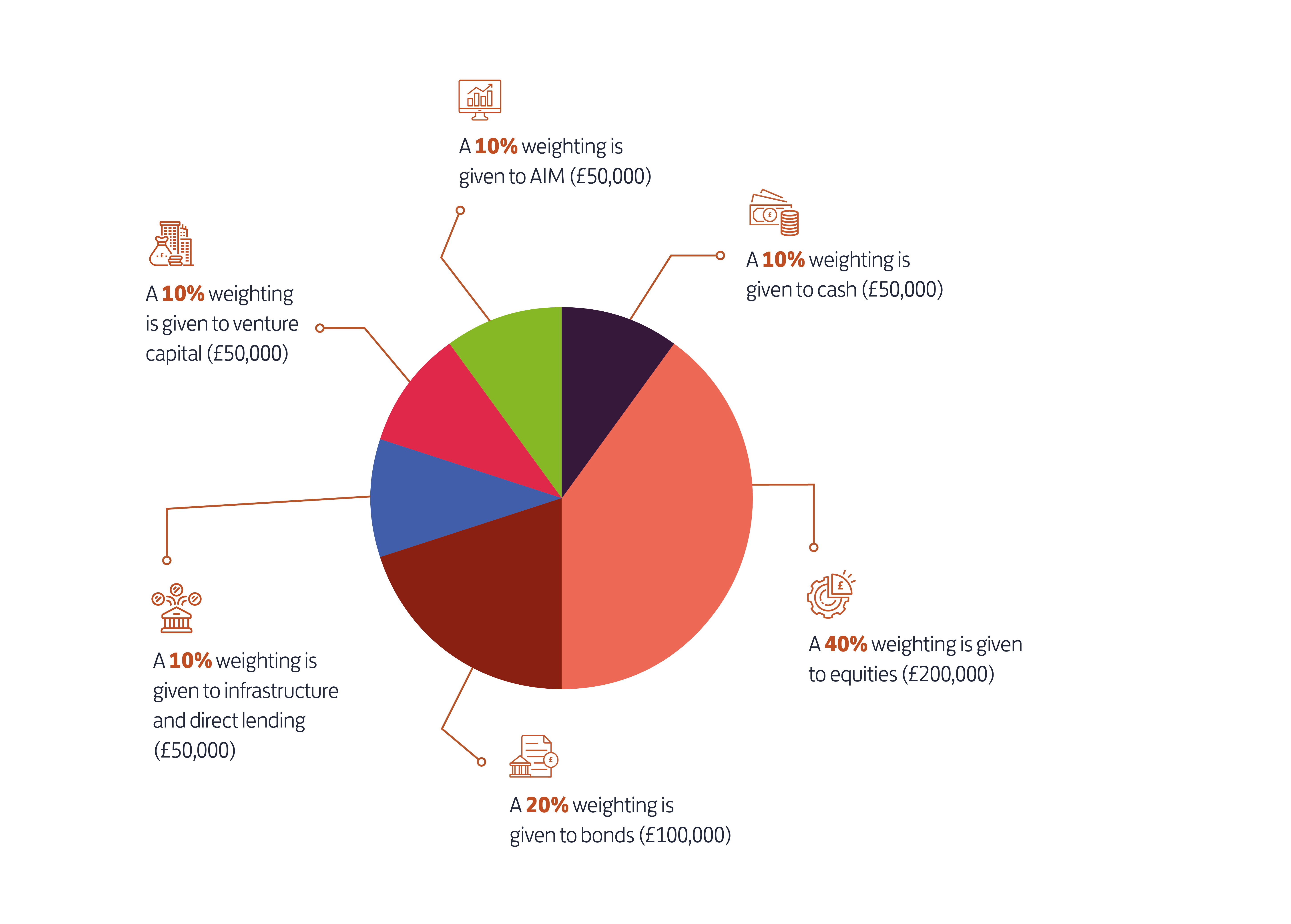

To demonstrate this, below is a truly diversified portfolio for a hypothetical investor with £500,000 to invest. A 10% weighting is given to cash, 40% to equities and 20% to bonds. We then allocate 10% to each of these additional asset classes: AIM, infrastructure and direct lending, and venture capital.

Additional Tax Benefits Available

Additional Tax Benefits Available

As we have outlined on page 8, using portfolio 3 brings the investor an additional £67,000 capital after 15 years, compared to a traditional ‘balanced’ portfolio.

The inclusion of the three additional asset classes also brings a range of tax benefits, which can further increase the risk-adjusted returns of the portfolio for the long-term investor.

Using this approach makes it possible to increase potential returns without fundamentally altering the investor’s risk budget, from an asset allocation perspective, while simultaneously ensuring the client can claim several tax advantages. While liquidity factors would also need to be considered, this approach could support both the need for, and the value of, high quality ‘holistic’ financial advice.

The Potential Disadvantages of this Strategy

Although there are many benefits of applying what we consider to be a more holistic asset allocation, it is important to acknowledge the potential disadvantages of an approach that focuses on using tax advantaged solutions.

For instance, the asset classes/products we have mentioned are rightly considered to be high risk products. It is important to acknowledge for tax-advantaged products that all capital is at risk. But not all products are the same. Choosing the right type of product suitable to the client’s needs and ensuring detailed due diligence can mitigate these risks as much as possible.

Liquidity for these types of investments can be a challenge, but again varies from product to product. For example, some Business Relief-qualifying investments offer quicker access than others and AIM investment vehicles can offer improved liquidity.

Beyond the investment risks, advisers will also have other disadvantages to consider. For instance, professional indemnity (PI) insurance costs may increase as a result of writing tax-advantaged business. This should be investigated on an adviser specific basis. Although there could be potential increased costs, in many circumstances financial advisers that already have a rigorous process of advice and product selection see no material impact to their premiums.

And while these investment solutions may not be available on standard investment platforms, the increasing use of technology and back-office systems mean advisers should be able to aggregate this information more easily. And while a number of these solutions can be much more complex than a traditional pension, General Investment Account or Individual Savings Account, this complexity is due to the significant tax benefits that can be claimed from them. Therefore, it could be argued that they support an increasingly more holistic view of advice.

In this regard, financial advice is essential. Taking a holistic approach to an investor’s requirements – from portfolio optimisation through to frequency of drawdowns and tax implications – means advice is at the forefront of this process. A well-constructed financial plan should then allow clients to benefit from these assets and important tax reliefs, without the ‘tax tail wagging the investment dog’. Moreover, clients can still use an MPS portfolio for liquidity and regular drawdown purposes.

Summary

After careful selection of the most appropriate investment manager, looking beyond traditional asset classes has the potential to increase client returns, without ratcheting up portfolio risk overall, provided the assets are uncorrelated with the core portfolio. Further, if certain products are selected these asset classes could potentially come with a range of added tax incentives, such as Income Tax relief and Business Relief, meaning the portfolio could possibly achieve even higher returns (pushing upwards towards the efficient frontier) across a long-term investment horizon.

It must be stressed that if these higher risk products are selected then the importance of the adviser cannot be understated. Only they will be able to assess who are the appropriate client for this strategy.

Will tax-advantaged investments help shape the advice landscape for more clients in the future? We think so, and others agree. A recent FT Adviser article highlighted pension research from The Wisdom Council warning that due to personal tax allowance freezes, even those reliant on the state pension for income could inadvertently trigger a tax liability. For example, it suggests pensioners now only need to earn £1,969.80 of income before they start paying income tax. Applying a tax-based investment approach is likely to become integral to the advice process.

This is not about investing because of the tax benefits, but about incorporating these tax advantaged assets as part of a diversified portfolio within an overall financial planning framework. This approach could give clients the best of both worlds: a diversified portfolio with added tax reliefs on top.

This discussion paper has been written to encourage debate. So, we would love to hear from you to discuss the merits of this deeper, more comprehensive approach to diversification. If you have any comments or questions on any aspect of our support services for financial advisers, feel free to contact us.