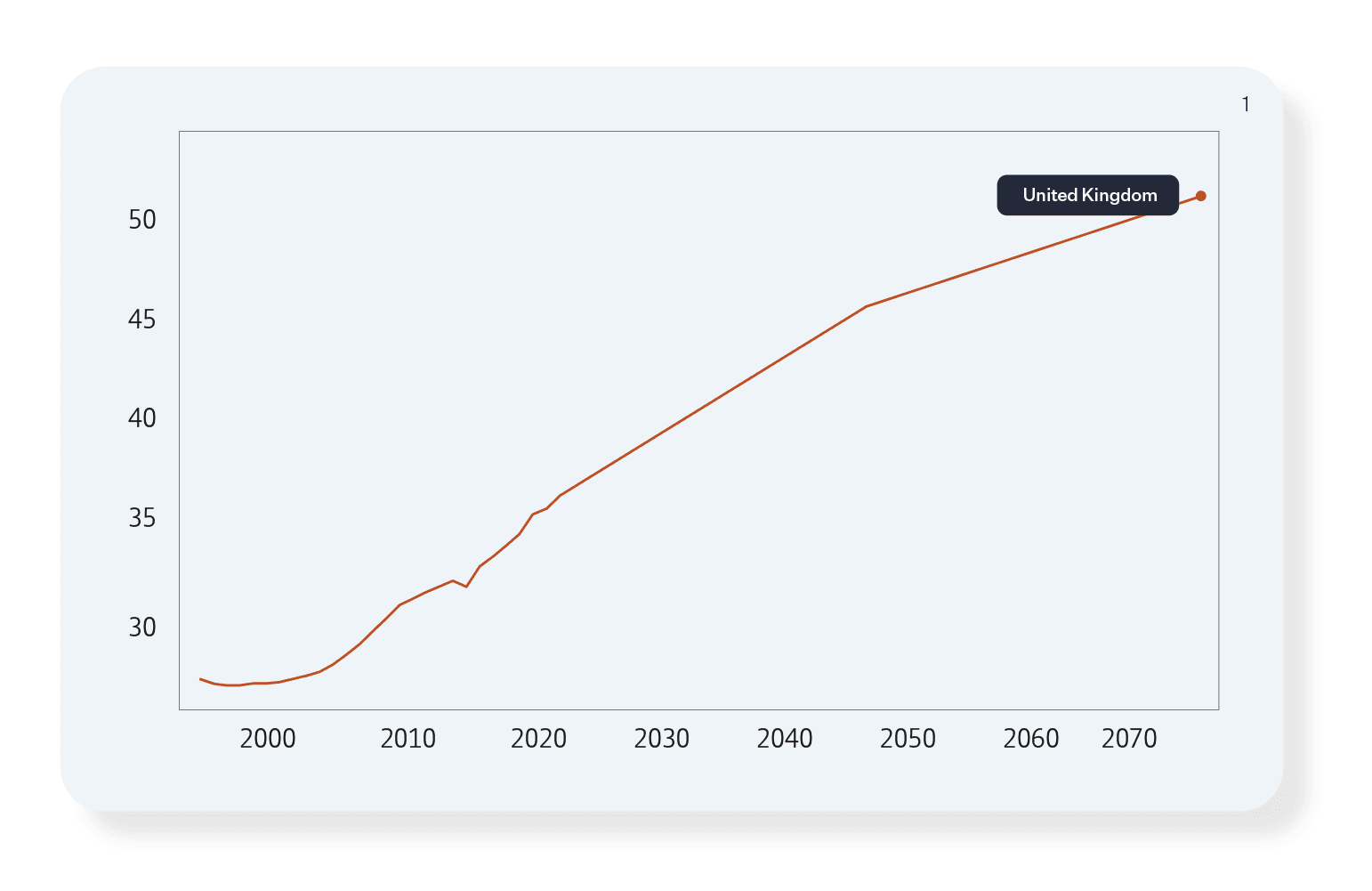

Care homes have a vital role to play in the wider health and social care provision across the UK. People are living longer than ever before, thanks to better access to nutritional food and advances in healthcare. The Organisation for Economic Co-operation and Development (OECD) old-age dependency ratio compares the number of people aged over 65 to those of working age, between 20-65. As you can see below, forecasts estimate the older age demographic growing at three times the rate of the younger demographic.

This will inevitably increase the pressure on health and social care services across the nation. Which means it’s more important now than ever before to plan ahead for the costs associated with care needs in later life.

What is the cost of later life care?

Understandably, everybody will age differently. Factors such as nutrition, exercise, lifestyle and mental health will all have an influence on how your body and mind change with age. Culturally, people will also have different attitudes towards the type of help and support they would like to receive as they age.

Examples of costs to consider include:

- Home delivered meals

- Maintenance help for your home such as cleaners and gardeners

- Domiciliary care – regulated care and nursing provision in your own home

- Retirement community – independent living in a community of like-minded people, where there is the option for care giving services as well as lifestyle activities, sports and social programmes.

- Assisted living – living independently a self-contained community but with help and support provided on site

- Care homes – renting a room in a home operated by a regulated care provider, who provide all your domestic and care-giving needs. These can be residential only, or with nursing care.

It’s a common misconception that when we need elderly care support, it will be provided free of charge by the NHS. Understandable given that for most of us, we have been lucky to benefit from NHS healthcare through our lives until that point.

The reality is that you will be means tested to determine whether you are financially able to cover your own costs. The more money you have, the more you'll be expected to pay. If the council thinks you have reduced your wealth on purpose, it might stop you getting any type of financial help.

An English or Northern Ireland local council helps to pay for care costs if you have less than £23,250, a Scottish local council looks for £28,750, a Welsh council looks for £50,000, from any of the following:

- earnings

- pensions

- benefits (including Attendance Allowance or PIP)

- savings

- property (including overseas property). This is not included if your spouse or partner will remain in the property after you move to a care home

The more you have above the threshold, the more you will be required to pay yourself. **

The monthly average cost of residential care is £2,816 and receiving nursing care in a care home costs on average £3,552. In a care home, nursing care is more expensive than residential care. Care homes that provide specialist care, such as dementia care, will normally charge a higher fee. ***

Preparing for later life costs, from a younger age

Helping clients understand the potential future costs, and prepare for them, doesn’t have to be a difficult conversation. It’s better to be prepared and have the freedom of choice for how you would like your care provided when that time comes.

Enterprise Investment Schemes (EIS) and Venture Capital Trusts (VCTs) offer an alternative investment solution alongside any existing pension schemes and ISAs. For anyone who has reached their annual contribution or lifetime contribution to their pension or ISA, EIS and VCT products offer the opportunity for further growth in personal wealth as well as income tax rebate equivalent to 30% of the initial investment. These investments must be held for a fixed period to qualify for their income tax relief.

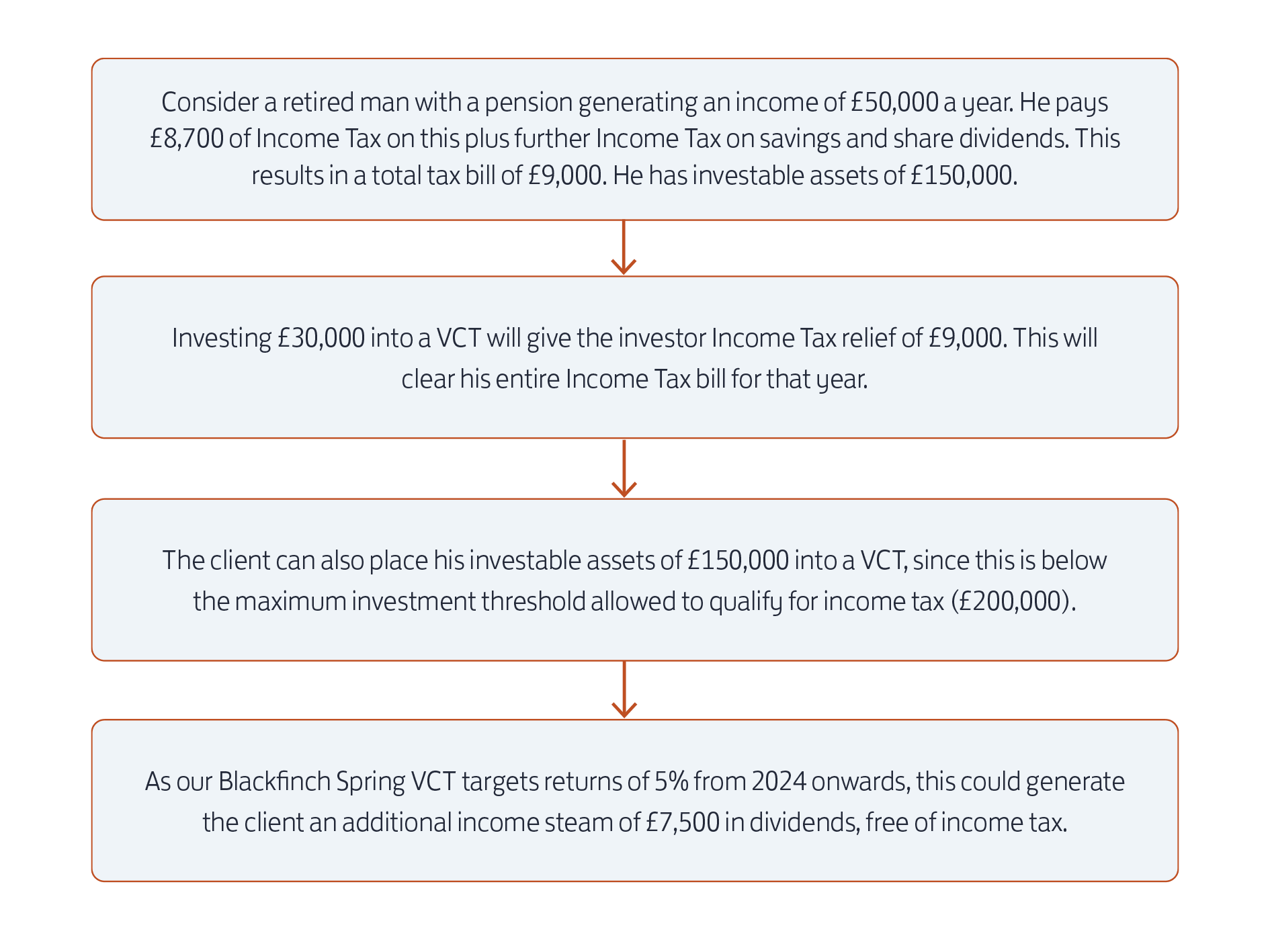

In addition, EIS and VCT products can be used to mitigate income tax charged against drawdowns from a pension. Here we work through a post-retirement example using VCT:

On top of this, any growth of the investment in a VCT is exempt of Capital Gains Tax.

Once the client has achieved their investment goals for care costs, or if the need for care becomes more realistic, they can consider transitioning towards an Inheritance Tax product such as Adapt IHT. Adapt IHT is more focused on wealth preservation and steady returns whilst retaining access to capital and also the option of taking regular withdrawals if required to help towards care.

Additional benefits

EISs are 100% free of IHT after two years, giving them a key role in estate planning alongside pensions, and can also benefit from loss relief. Additionally, both EIS and VCT are exempt from Capital Gains Tax.

Both EIS and VCT investments are portfolios of small businesses offering opportunity for high growth, unlisted on the stock market. As a result, they hold low correlation to any market turbulence and stock volatility and can provide clients with greater diversity across their investments.

Easier access

For those clients who think they may not be able to meet the minimum holding period of EIS or VCTs, a different route could be to look at the Alternative Investment Market (AIM). Our AIM portfolios are available in both Income or Growth strategies and can also be taken in an ISA wrapper.

In addition to the well-known tax benefits of an ISA, investors will also be able to mitigate Inheritance Tax if the shares have been held for a minimum of two years and at the time of death. On top of this, dividends are free of Income Tax and growth is free of Capital Gains Tax.

Our Adapt AIM solution allows investors to retain control of their capital, so should their personal circumstances change they will be able to withdrawn their funds at any time.

If you’re thinking about planning for later life care costs, then speak to one of our team today about our Adapt AIM ISA, EIS and VCT products. Our range of tax efficient savings can be combined in a number of different ways to help your clients reach their financial goals.

Your capital is at risk. The value of your investments could go up as well as down and you may not receive back the full amount you invest.

*Source: OECD (2022), Old-age dependency ratio (indicator). doi: 10.1787/e0255c98-en (Accessed on 20 May 2022)

**Source: Financial assessment (means test) for social care - NHS

***Source: Care Home Fees And Costs: How Much Do You Pay In 2022/23?