INFLATION RATE AND CONSUMER PRICE RISES BOTH SLOWED BY PANDEMIC

The ongoing pandemic caused by the coronavirus has affected economies and financial markets across the globe. A key economic indicator is inflation as it shows the interplay between supply and demand within an economy. Both of these have been heavily impacted throughout the pandemic, due to lockdown measures and subsequent government support schemes.

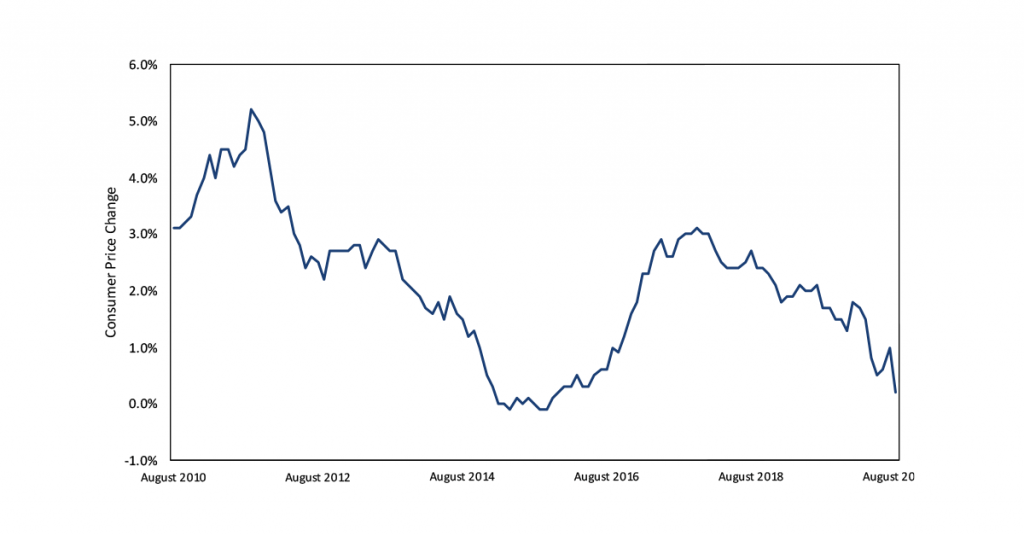

The Office for National Statistics (ONS) released UK inflation data for August today. This showed consumer prices rising at an annual pace of 0.2%, or down from a previous 1% annual rise in July. UK inflation has not been at this low rate since the end of 2015.

EFFECT OF GOVERNMENT STIMULUS MEASURES AND REDUCED CONSUMER DEMAND

The ONS attributed the large month-on-month fall in consumer prices to discounted meals arising from the Eat Out to Help Out Scheme and VAT cuts for the hospitality sector. Other small contributions came from falling air fares, and clothing prices rising less than in the same period one year ago. In fact, the fall in prices for restaurants and hotels was the first annual contraction for the sector since records began in 1989.

These factors and their influence on consumer prices can be traced back to the pandemic. The Eat Out to Help Out Scheme and VAT cuts are stimulus measures the Government enacted to support the UK economy. Meanwhile falling air fares, and the absence of rises in clothing prices, common at this time of year, also highlight lingering weakness in demand.

CONTINUED MONITORING OF INFLATION AS KEY TO PORTFOLIO CONSTRUCTION

The inflation data released today suggests that the Bank of England will continue to be accommodating in the medium term, as it targets an inflation rate of 2%. This is far and above the 0.2% reading for August. Further loose monetary policy from the Bank of England should support asset prices over this period. Although we cannot predict how severe any potential second wave of infections will be, nor future government stimulus plans, we continue to monitor for inflationary pressures resulting from the end of VAT cuts and rebounds in oil prices.

All the portfolios in Blackfinch Asset Management’s ranges are globally diversified. Each has an objective of beating inflation, as measured by the Consumer Price Index, by a defined amount over a rolling five-year basis. We also offer a portfolio designed to deliver a minimum income yield of 3.5% per annum after charges. Inflation is therefore a key consideration in portfolio construction. We will continue to update you on our portfolio activity as the economic outlook evolves.

Capital at risk